The purpose of the mechanism is to make it possible to react to a severe recession with an economic stimulus, i.e. to decide on a one-off increase in expenditure in the state budget.

At the beginning of its government term, Prime Minister Antti Rinne’s Government introduced a new mechanism for exceptional circumstances into the spending limits rule. The mechanism is activated only in the event of a severe recession. The mechanism enables the Government to increase the expenditure budgeted for the government term by a total of EUR 1 billion. However, this increase should be implemented in such a manner that the amount spent in one year does not exceed EUR 500 million.

The success of the mechanism in stimulating the economy depends on how exceptional the recession must be to activate the mechanism, and whether the recession is detected in a timely manner. The Government Programme answers these questions by stating that the activation of the mechanism is based on an overall assessment of the state of general government finances. The assessment is based on independent situational assessments by the Bank of Finland, the Research Institute of the Finnish Economy, the Labour Institute for Economic Research, and Pellervo Economic Research PTT, as well as an analysis by the Economics Department of the Ministry of Finance.

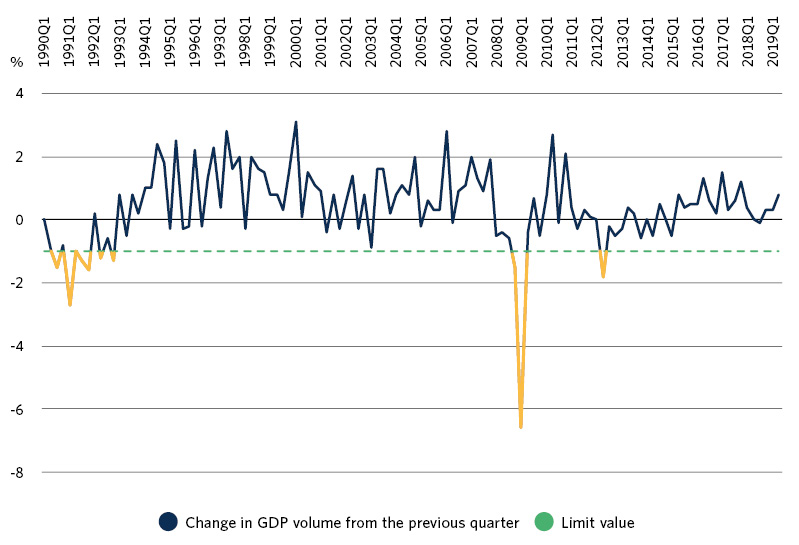

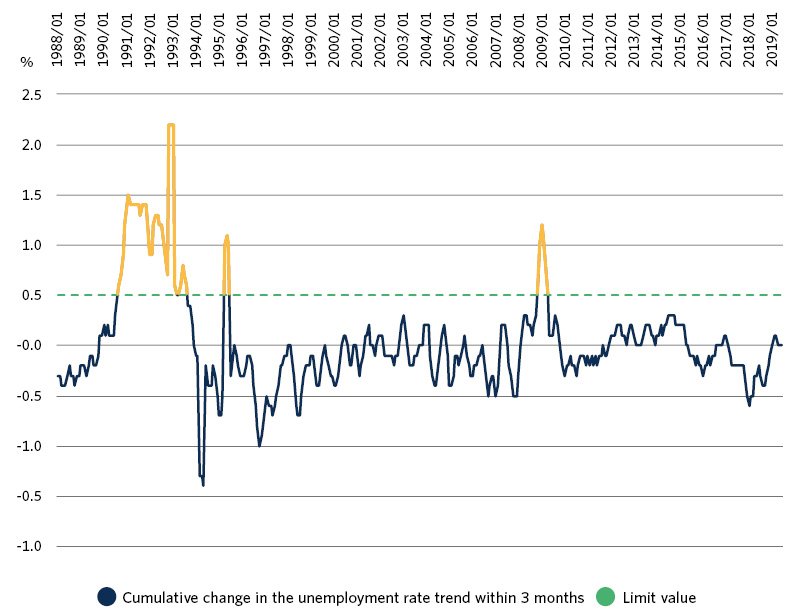

The recession should not be caused by the Government’s activities, but it could be the consequence of a serious economic disruption in the euro area, for example. In addition, indicative criteria are defined for a serious economic disruption in Finland. Such criteria include that the GDP in Finland is falling by at least 1.0 per cent in two consecutive quarters, and that the trend in the unemployment rate shows a cumulative increase of at least 0.5 percentage units within three months.

Can the mechanism identify a severe recession?

It is not possible to assess how well the mechanism for exceptional circumstances helps the Government to react to changes in economic cycles until it has been activated for the first time. However, the numerical indicators defined for the mechanism give us an idea of the kind of recession it would take to activate it. In recent history, the GDP has fallen by at least 1.0 per cent in two consecutive years twice: in 1990–1991 and at the turn of 2008–2009. We can thus assume that the idea is to activate the mechanism only in the event of an exceptional and severe recession.

The unemployment rate reacts to a recession with a delay. During the same period, the trend in the unemployment rate has shown a cumulative increase of at least 0.5 percentage units within three months from November 1990 to November 1993, from July to September 1995, and from February to July 2009. The unemployment rate trend provides further information on the severity of the recession. The criterion seems to be correctly set so that it would also have identified the exceptional recessions in 1990–1991 and 2008–2009. However, in view of the activation of the mechanism, the unemployment rate trend does not seem to provide information early enough to support decision-making.

The wording of the Government Programme leaves it somewhat unclear whether the mechanism can be activated proactively if the GDP is expected to decrease in the following quarter or quarters. The use of forecasts is risky, as it is extremely difficult to forecast sharp turns in economic cycles.

On the other hand, waiting for the data to be confirmed causes a delay in the use of the mechanism particularly in situations where the fall in GPD is steep but of short duration. In such a case, the optimal time for an economic stimulus may be over quickly. In practice, it is unlikely that the activation of the mechanism would take place at the right time in view of the cyclical conditions, unless the recession lasts a very long time.

Timely use of the mechanism may also be hampered by the slow decision-making process. A multi-step process is required merely to activate the mechanism. It is also necessary to find suitable uses for one-off increases in expenditure. In addition, after the decisions have been taken, it takes time to implement them.

In practice, even if there is wide support for decisions on stimulus measures during a recession, the growth in the budget deficit as a result of decreasing revenue and increasing cyclical expenditure causes expenditure control pressures at the same time. This may complicate the activation of the mechanism, which will further increase the deficit.

Do we need a mechanism for exceptional circumstances?

The existence of the mechanism for exceptional circumstances as part of the spending limits rule can be considered justified, because in a severe recession it is necessary to promote domestic demand through stimulus measures, which increase central government expenditure. It may also be useful to provide the spending limits rule with clear instructions on how to operate in such a situation. The spending limits rule is set for a period of four years, and it is not always possible to forecast an economic downturn occurring during this period.

However, the spending limits rule already includes certain elements for smoothing the cyclical fluctuations. The most important ones of these are automatic stabilisers, i.e. unemployment and social expenditure, which increase during an economic downturn and decrease during an economic upturn. Stimulus measures falling outside the scope of the spending limits rule include tax reductions, contingent liabilities and financial investments.

During the recession of 2008, the economy was stimulated by a combination of tax reductions, contingent liabilities, financial investments, and allocations of expenditure. The amount of expenditure within the spending limits rule allocated to stimulus measures at the time seems to have been at a similar level with the increases in expenditure enabled by the mechanism for exceptional circumstances, i.e. about EUR 1 billion in total in 2009 and 2010 (Economic Survey of the Ministry of Finance, September 2009). It is naturally difficult to estimate which of these allocations of expenditure were implemented only in order to achieve an economic stimulus. However, the spending limits rule does not seem to have prevented allocations of expenditure to smooth the cyclical fluctuations during the recession in 2008.

Rather than on expenditure decisions, the stimulus measures in connection with the financial crisis in 2008 were focused on contingent liabilities, financial investments and revenue losses, which were implemented for instance by tax cuts and by removing the employer’s Kela (the social security institution of Finland) contribution. The revenue losses in 2009 and 2010 were estimated at about EUR 4.6 billion, whereas the budgeted contingent liabilities and financial investments totalled about EUR 7 billion (Economic Survey of the Ministry of Finance, September 2009). In view of this, it seems unlikely that the mechanism for exceptional circumstances would necessarily replace stimulus measures falling outside the spending limits rule.

The spending limits can also be set to be expansionary or contractionary, and the expenditure falling within the scope of the spending limits rule can be allocated more or less advantageously from the perspective of an economic stimulus. In the current government term, the spending limits have already been set at a level that seems to be suitable in view of an economic stimulus. Moreover, permanent increases in expenditure and a future-oriented investment programme, aiming mainly to promote demand, have been implemented within the scope of the spending limits rule.

In this kind of situation, the spending limits rule may offer enough alternatives for counter-cyclical measures even without a mechanism for exceptional circumstances. Before the mechanism for exceptional circumstances is activated, the added value it provides should also be assessed in relation to other stimulus measures taken within the scope of the spending limits rule.