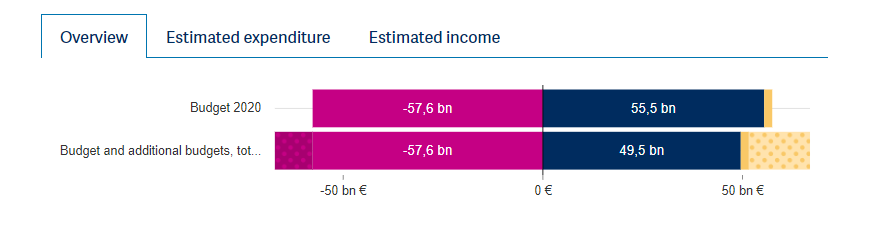

Parliament has taken a decision on the fifth supplementary budget for 2020. The estimates of the development of tax revenue made during the spring and summer have been adjusted in the fifth supplementary budget. The development of all estimated income and expenditure can be examined in the visualization compiled by the National Audit Office.

The amount of taxes accrued by the state has been higher than expected, and therefore the estimated need for government borrowing has reduced by over EUR 1 billion. The most significant change has taken place in taxes levied on the basis of turnover. Because of the coronavirus crisis, companies were offered the option of postponing their tax payment, but they have not resorted to this option to the extent expected.

The biggest change in appropriations can be seen in government aid to local government, which has decreased by about EUR 430 million. This, too, is attributable to the development of tax revenue, which has been better than forecast. The latest supplementary budget includes a few additional appropriations: e.g. EUR 104 million for supporting renewable energy and EUR 60 million for coronavirus subsidies granted on social grounds.

The visualization makes it possible to examine how the estimated income and appropriations have changed in each of the five supplementary budgets. At the end of September, the Government submitted the sixth supplementary budget to Parliament. The only appropriation included in it is EUR 200 million for the coronavirus costs of social and health care. Examine the visualisation: Economic impacts of the coronavirus pandemic.